Introduction to Computational Finance with Matlab

In today’s fast-paced and ever-changing financial landscape, the use of technology and data analysis has become increasingly important. One such area where technology has had a significant impact is in the field of computational finance. Computational finance involves the application of mathematical and statistical methods to financial markets and investment strategies, and it has become an essential tool for financial professionals.

In this blog post, we will explore the fundamentals of computational finance and how it is used in the financial industry. We will also take a closer look at the role of Matlab, a popular programming and numerical computing platform, in computational finance. Additionally, we will delve into the ways in which Matlab is used for financial modeling, simulating financial markets, and implementing portfolio optimization strategies. Whether you are a finance professional or simply interested in the intersection of finance and technology, this blog post will provide you with a comprehensive introduction to the world of computational finance with Matlab.

What is Computational Finance?

Computational finance is a field that involves the use of mathematical models and computer algorithms to make financial decisions, analyze markets, and manage risk. It combines the principles of finance, mathematics, statistics, and computer science to develop and implement models for valuing assets, assessing risk, and making investment decisions.

One of the main goals of computational finance is to develop and implement efficient and accurate methods for pricing financial instruments such as stocks, bonds, options, and derivatives. These methods are used by investment banks, hedge funds, and other financial institutions to make informed decisions about trading and investment strategies.

Computational finance also plays a crucial role in risk management and portfolio optimization. By using advanced mathematical models and computer algorithms, financial professionals can analyze complex data sets, identify patterns and trends, and optimize the performance of investment portfolios while minimizing risk.

Overall, computational finance is a rapidly growing field that is reshaping the way financial professionals analyze and manage market data, make investment decisions, and manage risk.

The Role of Matlab in Computational Finance

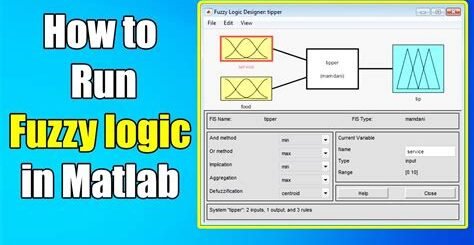

Matlab, a popular programming language and numerical computing environment, plays a crucial role in computational finance. With its powerful data analysis and visualization capabilities, Matlab is widely used in the financial industry for tasks such as pricing derivatives, risk management, and building trading strategies.

One of the key strengths of Matlab in the context of computational finance is its robust toolboxes for mathematical and financial modeling. These toolboxes provide functions and algorithms for solving complex mathematical problems, simulating financial instruments, and implementing various quantitative finance techniques.

Furthermore, Matlab offers a high level of flexibility and scalability, allowing financial professionals to efficiently process large datasets and perform advanced analytics. Its integration with other programming languages and data sources makes it a valuable tool for developing and deploying financial models and algorithms.

Overall, the role of Matlab in computational finance is indispensable, empowering finance professionals and researchers to tackle challenging problems in the ever-evolving financial markets.

Understanding Financial Modeling with Matlab

Understanding Financial Modeling with Matlab

Financial modeling is an essential tool used in the finance industry to make informed decisions about investments, risk management, and financial planning. By using Matlab, a powerful programming language and environment, financial professionals can create complex models to analyze and predict financial data.

Matlab provides a wide range of built-in functions and toolboxes that are specifically designed for financial modeling. These tools allow users to perform advanced statistical analysis, time series analysis, and simulation of financial markets. With Matlab, financial analysts can build models to assess the impact of various economic factors on investment portfolios and make more accurate predictions about market trends and risks.

One of the key advantages of using Matlab for financial modeling is its flexibility and scalability. It allows users to easily customize and extend their models to accommodate new data sources, market conditions, and investment strategies. Additionally, Matlab’s support for parallel computing and cloud integration enables users to handle large datasets and complex calculations with ease, making it a valuable tool for real-time financial analysis and decision-making.

In conclusion, understanding financial modeling with Matlab is crucial for finance professionals who want to gain a competitive edge in today’s dynamic and complex financial markets. With its advanced capabilities and extensive resources, Matlab provides the tools and infrastructure needed to develop sophisticated financial models that can help investors, traders, and financial institutions make more informed decisions and achieve better outcomes.

Simulating Financial Markets using Matlab

Simulating Financial Markets using Matlab involves utilizing advanced mathematical models and algorithms to replicate real-life market conditions and behavior within the software environment. By creating these simulations, financial professionals and researchers can gain valuable insights into market dynamics, risk management, and investment strategies.

One of the key advantages of using Matlab for simulating financial markets is its flexibility and extensive library of built-in functions for statistical analysis, time series modeling, and econometric techniques. This allows users to develop complex simulation models that can accurately capture the complexities of real-world financial markets.

Furthermore, Matlab provides a user-friendly interface for visualizing and interpreting simulation results, making it easier for analysts and decision-makers to understand the implications of different market scenarios. Whether it’s simulating stock price movements, interest rate fluctuations, or option pricing, Matlab offers powerful tools for exploring various market dynamics and their potential impact on investment portfolios.

In addition, the integration of Matlab with other financial software and data sources enables users to incorporate real-time market data and industry-specific information into their simulations, enhancing the accuracy and relevance of the results. This makes Matlab a valuable tool for risk assessment, hedging strategies, and overall portfolio management within the context of dynamic and unpredictable financial markets.

Implementing Portfolio Optimization in Matlab

Portfolio optimization is a crucial aspect of investment management, as it aims to construct a portfolio of assets that maximizes return for a given level of risk. Matlab, a powerful tool for numerical computation and data visualization, provides a range of functions and capabilities that can be leveraged for implementing portfolio optimization strategies.

One of the key functions in Matlab for portfolio optimization is the Portfolio object, which allows users to specify their investment universe, constraints, and objectives. This includes defining asset returns, covariance matrix, and constraints such as maximum and minimum weights for each asset, as well as overall portfolio volatility and expected return targets.

Utilizing the Portfolio object, investors can perform various optimization techniques such as mean-variance optimization, minimum variance optimization, and risk-parity allocation. These methods enable the creation of diversified investment portfolios that align with specific risk and return preferences.

Additionally, Matlab offers optimization solvers such as fmincon and quadprog, which can be employed to find the optimal portfolio weights that satisfy the defined constraints and objectives. These solvers utilize mathematical algorithms to efficiently search for the best combination of assets that maximizes portfolio returns while minimizing risk.